The EUR/JPY slipped lower after reaching a two-week high near 123.70 on Tuesday, flirting with the 50% Fibo level of 123.07. The technical outlook supports that the slightly bearish movement is expected to continue in the short-term. The RSI is expanding to the downside and the stochastic oscillator is trimming lower in the 4-hour chart.

Moreover, another movement to the downside could see support at the short-term moving averages around 122.90. A breach of these support levels could send the pair until the 122.50 support, taken from the latest lows ahead of the four-month trough of 122.07.

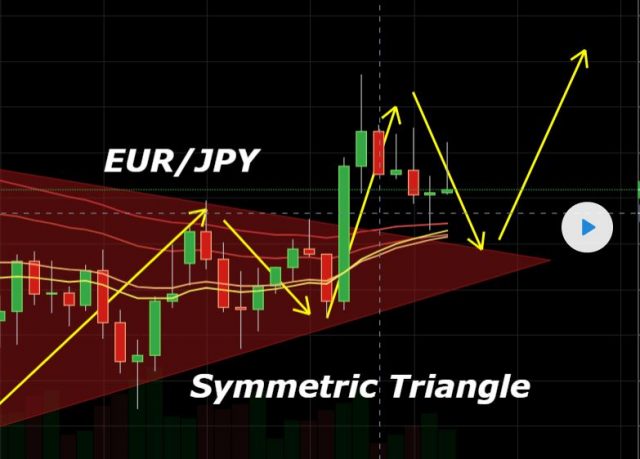

In case of bullish power, the market could see resistance at the 123.70 level while a close above this resistance could see a retest of the 38.2% Fibonacci of 123.90. On the 4 hour chart, the EUR/JPY has violated the symmetric triangle pattern, which is suggesting a strong bullish movement in EUR/JPY.

R3: 125.41

R2: 124.34

R1: 123.85

Key Trading Level: 123.26

S1: 122.78

S2: 122.19

S3: 121.12

In the medium-term, EURJPY has been in a descending action over the last three month, and sellers should be expecting for a drop below the 4-month bottom for further selling interest. All the best