Facebook Uncovers a Second Crypto Asset: The Libra Investment Token

The Pillars of the New Coin

The announcement of the Libra cryptocurrency is based on three pillars, with most of the  ideas inherited from Bitcoin and Ethereum:

ideas inherited from Bitcoin and Ethereum:

- The Libra Blockchain

- The MOVE programming Language

- The Libra BFT Fault Tolerant protocol

Founding

The coin will be entirely founded and stable, according to the published white paper, meaning that for every coin created and purchased by the public its value will be backed by a similar amount of assets in what they call The Libra Currency Reserve.

Libra’s transactions, as all cryptocurrencies have, will be handled by the Libra Network, which, in turn, will be ruled by the Libra Association, a not-for-profit organisation with headquarters cleverly chosen to be in Geneva, Switzerland.

Validation

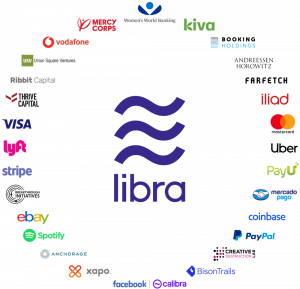

As said, the validation of the Libra transactions will be carried out by the Block Validators. Currently, the group of validators are 28 companies which include Mastercard, Visa, Paypal, Facebook/Calibra, Spotify, Anchorage, Andreessen Horowitz, Coinbase and others.

The Libra Association

Validators will have a seat in the Libra Association but are asked to invest a minimum of $10 million. Investors will receive a proportional amount of Libra Investment Token. Each $10 million lot entitles the investor to one vote but capped to less than 1 per cent of the voting power no matter how many $10 million lots had invested. The monetary rewards are not capped, however, and will be proportional to the investment.

Validators will have a seat in the Libra Association but are asked to invest a minimum of $10 million. Investors will receive a proportional amount of Libra Investment Token. Each $10 million lot entitles the investor to one vote but capped to less than 1 per cent of the voting power no matter how many $10 million lots had invested. The monetary rewards are not capped, however, and will be proportional to the investment.

Image source:https://libra.org/en-US/partners/

Facebook will be represented in the governing consortium by Calibra; a subsidiary launched at the same time than the Libra Association. The White Paper says, though that although in its beginnings Calibra will play a leading role in the governance of the Libra Association its position will be downgraded in the future to match the rest of the members.

The Current Project Stage

Currently, the Libra project is in its development phase. Its release is planned for mid-2020 and will initially support 1,000 payment transactions per second. As a comparison, Visa is able to process 24,000 transactions per second and according to an article by The Wall Street Journal, Alibaba Group’s Alipay has processed more than 250,000 transactions per second on a busy shopping day in 2017.